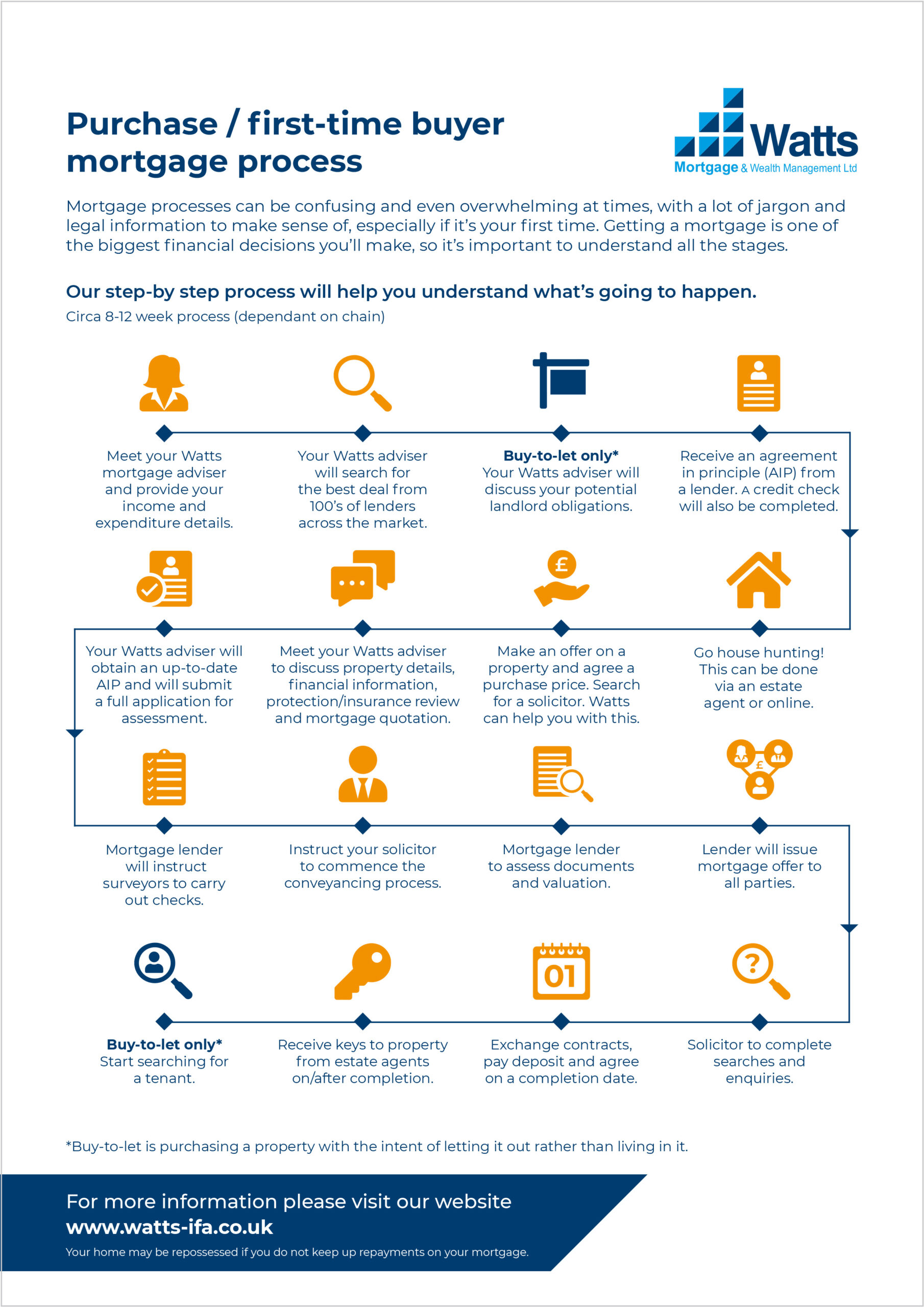

BUY-TO-LET MORTGAGES

If you’re considering investing in property, a buy-to-let mortgage could be the key to generating rental income and building long-term wealth. At Watts Mortgage and Wealth Management Ltd, we provide whole-of-market mortgage advice, tailored to help landlords – whether first-timers or experienced investors – to find the best buy-to-let mortgage deals.

Buy-to-let mortgages can have their risks, with rental income and house prices varying over the years. You are also relying on your tenant to keep up with their payments. However, by making sure you have all the necessary information before deciding to take out a buy-to-let mortgage, you can assess the risks and the benefits to make an informed decision.

A buy-to-let mortgage is a type of mortgage specifically designed for people who want to buy a property to rent out, rather than live in. Unlike residential mortgages, buy-to-let mortgages typically require a higher deposit and are assessed based on the potential rental income of the property.

Independent experts: Whole-of-market mortgage brokers offering unbiased advice.

Exclusive deals: Access to buy-to-let mortgage offers not available on the high street.

Landlord-focused: Tailored advice for new landlords and established portfolio investors.

Beyond mortgages: Comprehensive financial planning and wealth management support.

Market insight: We help you navigate the ever-changing buy-to-let landscape with confidence.

End-to-end guidance: From borrowing and budgeting to tax implications, our qualified team at Watts is here to simplify the process and find the right solution for your needs.

- Understand your finances

Lenders usually require a minimum 25% deposit however Watts Mortgages do have access to lenders that will accept 15% deposit subject to lenders criteria. Ensure your personal finances are in good shape as this can impact approval. - Know the rental yield

Your mortgage will be assessed based on the expected rental income. Aim for a yield that comfortably covers the mortgage and leaves room for profit. - Research the area

Invest in locations with high rental demand – we offer local and national insights to help you choose wisely. - Consider future regulations

Stay informed about tax changes, Energy Performance Certificate (EPC) requirements, and tenant laws. We provide ongoing guidance to keep your investment compliant and profitable. - Work with an independent broker

As a whole-of-market adviser, we’re not tied to any lender, meaning we can access a wide range of buy to let mortgage products that suit your unique needs.

Whether you’re expanding your portfolio or buying your first rental property, speak to one of our independent advisers today for more advice by calling 01270 620555 or filling in the enquiry form. We’d be delighted to assist you.

MAKE AN ENQUIRY

Sian Wilcox

Senior Mortgage Adviser

“I’ve helped numerous clients successfully secure Buy to Let mortgages, whether they were first time landlords or experienced investors expanding their portfolios. I take pride in simplifying the process, finding competitive deals, and ensuring each mortgage is tailored to their investments goals.

I would be delighted to help all landlords navigate this complex area of the market.”

With our extensive experience and access to a vast lender network, Watts Mortgage & Wealth Management Ltd is the ideal partner for those seeking a tailored mortgage solution. Contact us today, and let our dedicated advisers guide you through the process.

AWARDS AND ACHIEVEMENTS

Buy to let mortgage FAQs

Yes, many lenders offer buy to let mortgages to first-time landlords. However, eligibility may depend on your credit history, income, and the projected rental income of the property. Our experienced advisers at Watts Mortgage and Wealth Management will guide you through the entire process, helping you understand your options and increase your chances of approval.

No, buy to let mortgages are intended for rental purposes only. If you plan to live in the property, you will need a residential mortgage.

Most lenders require a minimum deposit of 20–25%. The more you can put down, the better your mortgage rate is likely to be.

Yes. Many landlords now choose to use a limited company structure for tax efficiency. We can help you explore this route and find the best lenders who support it.

Like all investments, Buy to Let carries risks, including void periods, interest rate rises, and property value fluctuations. Our expert advice can help you plan for these.

FIND THE BEST MORTGAGE DEAL FOR YOU

Let us help you find the right mortgage for your home or buy to let.

- Completely free search

- Won’t affect your credit score

- Independent, UK-based advice

- Award-winning mortgage broker

Our mortgage advice

Many thanks for your expert advice when I wanted to remortgage my buy-to-let portfolio. Your whole market approach and willingness to go the extra mile to secure the best deals for each property has enabled me to significantly reduce my repayment costs and provided stability for the next five years.

O Mason

We are so pleased that we were able to complete on our new mortgage. None of it would have been possible if it wasn't for your superb knowledge, and persistence to chase down a good deal for us.

I Sykes

Awesome Team - you worked tirelessly for my family on a complex transaction to help secure our dream house. Always calm and professional under pressure and readily available. 5 stars from me!

S Sinha

I would like to thank you for all your help getting our mortgage for our new home. Your dedication and perseverance were amazing, and you got us a mortgage offer that suited our flexible requirements and budget. Once again, a big thank you!

M Cooke

I want to thank the Watts team for a fantastic remortgaging of my property. They were efficient, thorough, took time to get to know what I needed and helped push things through. Really happy with the service I received.

V McKay

If we can help with your mortgage needs, find out more here.

INDEPENDENT MORTGAGE ADVICE AND PROTECTION FOR YOU

Welcome to Watts!

Our friendly, knowledgeable and experienced team are here to help find the right mortgage and life insurance for you. We have helped thousands of clients, over 30 years buy their dream home and ensure their family is protected.

We are a family business and pride ourselves on our customer service. As an independent company, we can search from over 100 lenders and insurance companies to help you get the best deal.

Get a quick quote above or contact us today.

We search over 100 lenders to find the right mortgage for you

I just wanted to say a massive thank you for your assistance in my purchase. I would like to place on record my appreciation of the professionalism and tenacity of Emma. She has kept me fully updated in terms of progress and answered all of my questions in a timely manner. Great service and hope we can do business again in the future.

A. Henshall

NEWSLETTER SIGNUP

MORTGAGE TOOLS

Calculators to help you plan your mortgage payments and stamp duty rates.

TESTIMONIALS

Read what some of our existing clients have to say about our services.

ARRANGE A CALLBACK

Send us an email with your contact details and we’ll arrange for one of our advisers to call you back.